Predicts 2026: AI Splinters the Analyst Landscape

The Year of the Barbell

December 23, 2025 · AI, AR, & the Analysts #30 · Predicts 2026 #1

Weekly free research note.

AR Intelligence Snapshot

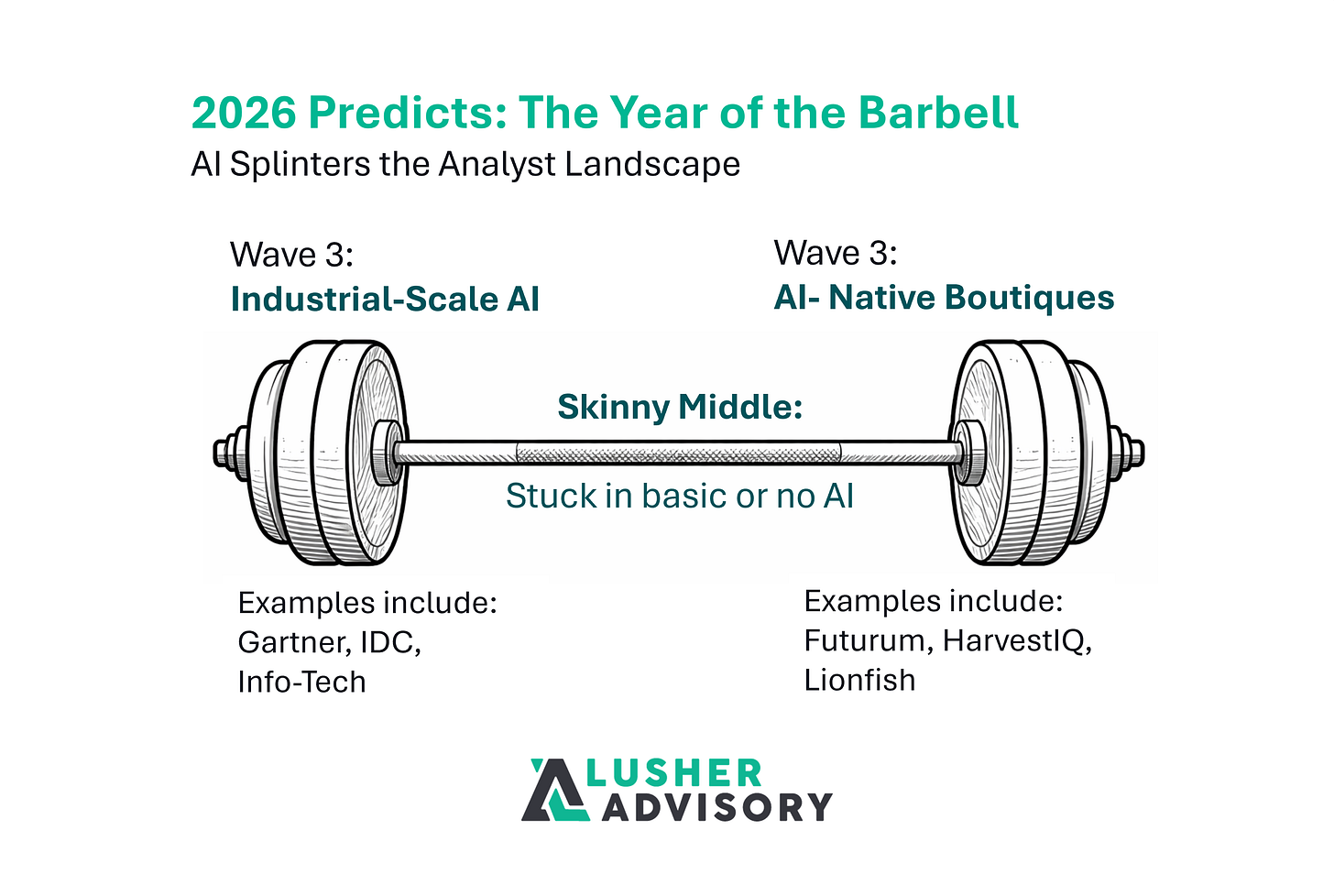

AI isn’t reshaping the analyst landscape evenly. It’s tearing the middle out of it.

For years, the IT industry analyst landscape has been described as a classic Long Tail: a small number of large firms on one end, a handful of mid-sized firms in the middle, and hundreds of boutiques and independent analysts stretching out on the other side. That model made sense in a world where research scaled linearly with headcount, publication cycles were measured in months, and insight production was fundamentally human-constrained.

But as AI becomes embedded in how research is created, delivered, and consumed, that familiar shape is breaking down. In its place, a barbell is emerging. On one end, large analyst firms are racing to industrialize AI—ingesting vast volumes of proprietary data, automating workflows, and building platforms designed to scale insight across thousands of clients. On the other, a growing group of AI-native boutiques is using focused data sets and aggressive tooling to move faster, specialize deeper, and punch far above their size.

What’s left in the middle is a thinning band of firms—of all sizes—that have not meaningfully adapted their research models to the new reality. This “skinny middle” isn’t failing because of poor analysis or weak expertise, but because it is increasingly squeezed between two very different, very effective AI strategies.

Why the Long Tail No Longer Fits

The Long Tail model assumed relatively even progress across the industry. Firms might differ in size or reach, but most operated within the same research cadence, the same publication rhythms, and similar constraints around analyst time and attention.

AI breaks those assumptions.

When insight can be accelerated through automation, reused across multiple outputs, and delivered continuously rather than episodically, advantage no longer accrues evenly. Instead, it concentrates—either where scale allows AI to be industrialized, or where agility allows AI to be deployed aggressively without legacy friction.

The result is not a smooth distribution of capability, but polarization.

Wave 3 and the Shift to a Barbell

The shift from a Long Tail to a barbell is accelerating because the analyst ecosystem is now rolling out Wave 3 of AI adoption.

Wave 1 (2023-2025): Chatbots as Better Search (e.g., Forrester Izola, HFS Research Ask HFS AI)

Wave 2 (2023–2027): Behind-the-Scenes Building

Wave 3 (2025-onward): New Functions, Workflows, and Business Models (e.g., IDC+AWS Quick Research, IT-Harvest Security Stack Analysis)

As Wave 3 takes hold, the gap between firms that have re-architected for AI and those still experimenting widens rapidly. Some firms are already operating at Wave 3, while others remain stuck in Wave 1—and it is this uneven progression that is turning the traditional Long Tail into a barbell.

The Two Ends of the Barbell: Industrial AI vs. AI-Native Insurgents

End One: Industrializing AI at Scale

On one end of the barbell are large, established analyst firms that are moving aggressively to industrialize AI across their research, advisory, and client-engagement operations. These firms are not simply adding AI features; they are re-architecting how insight is created and delivered. These firms include Gartner, IDC, and Info-Tech.

What these firms share is not just scale, but data density. Decades of accumulated intelligence are now being fed into AI systems designed to surface patterns, accelerate publishing cycles, and support analysts before, during, and after client engagements.

At this end of the barbell, competitive advantage comes from:

Proprietary data moats

Repeatable AI-powered workflows

Platformized research experiences

The ability to scale insight without linear headcount growth

This is AI as infrastructure.

End Two: AI-Native Boutiques Punching Above Their Weight

At the opposite end of the barbell are a growing number of boutiques and emerging analyst firms that are AI-native by design. These firms don’t have decades of legacy process to unwind—and that turns out to be an advantage.

Examples include Lionfish Tech Advisors, with its The Aquarium™ platform and RFI Response Generator; IT-Harvest’s HarvestIQ cybersecurity vendor platform powered by its massive database; and Futurum Group, which are building AI-augmented data pipelines tailored to specific domains that feed the Futurum Intelligent Platform.

These firms operate with smaller teams, narrower scopes, and faster experimentation cycles. Rather than attempting to match the breadth of the large firms, they compete on speed, focus, and adaptability—using AI to compress timelines, analyze larger data sets than their size would traditionally allow, and deliver insight in more immediate formats.

At this end of the barbell, competitive advantage comes from:

Agility over scale

Specialization over breadth

AI-first operating models

Rapid iteration rather than polished perfection

Why These Two Ends Reinforce Each Other

Firms at both ends of the barbell see the same thing. Large firms recognize that AI-native boutiques are moving faster and experimenting more freely. Boutiques recognize that large firms possess data assets and distribution reach they can’t easily replicate.

Both are adapting.

As large firms industrialize AI, they normalize faster cycles and higher expectations. As boutiques experiment aggressively, they reset what’s possible. Each raises the bar for the other — and the middle gets squeezed by default.

The Skinny Middle: Why “Good Enough” Isn’t Enough in Wave 3

The firms most at risk in the emerging barbell are not failing firms. They are often well-regarded, staffed by capable analysts, and trusted by loyal client bases. What makes the middle “skinny” is not quality—it’s momentum. Nor is this about firm size as firms of all sizes can be in the middle. It’s about operating models — how insight is produced, scaled, and delivered.

In Wave 3, “good enough” research processes increasingly translate into being too slow, too opaque, or too difficult to scale. Firms caught in the middle often fall into one or more familiar patterns.

Some are stuck in the trough of disillusionment, having experimented early with AI and concluded—too soon—that it wasn’t ready for serious research work. Others underestimate the impact on their own model, believing their expertise or relationships insulate them from structural change. Still others face genuine constraints: limited resources, limited data, or limited internal expertise to move beyond incremental experimentation.

The risk for the skinny middle is not sudden disruption, but quiet relevance erosion. As AI-enabled firms publish faster, respond sooner, and surface insights more continuously, influence shifts by default. By the time the impact is visible—fewer inbound briefings, fewer citations, slower engagement—the gap is far harder to close.

Wave 3 is unforgiving of indecision.

Influence of the skinny middle doesn’t vanish overnight. It just stops growing and slowly starts to fade.

What This Means for Analyst Relations Teams in 2026

For Analyst Relations teams, the barbell doesn’t invalidate existing best practices—but it does demand adaptation.

Re-audit analyst lists through a Wave 3 lens.

The key question is no longer “Who matters most today?” but “Where is influence forming next?”

Move from firm tiers to engagement portfolios.

AR strategies need to recognize where firms sit on the barbell and engage accordingly, rather than relying solely on static tiering models.

Optimize for speed and reusability.

As AI-augmented firms reuse inputs across multiple outputs, AR teams must prioritize clarity, consistency, and fast response over perfect customization.

Engage industrial AI firms as data pipelines.

Influence increasingly flows through cumulative inputs—briefings, inquiries, events, surveys—not isolated interactions.

Use AI-native boutiques as early signal generators.

These firms can surface emerging narratives and gaps early, providing valuable feedback loops.

Conclusion: The Barbell Is Structural, Not Temporary

The shift to a barbell-shaped analyst landscape is not a passing phase driven by hype cycles or tool adoption. It reflects a deeper change in how insight scales in an AI-enabled world.

As Wave 3 takes hold, advantage accrues to firms that either industrialize AI at scale or embrace AI-native agility. The middle doesn’t disappear overnight—but it thins as influence migrates toward the ends.

For AR teams, recognizing this structure early is the difference between reacting to change and shaping it.

The only open question is how quickly AR teams adjust — and whether they do so intentionally or reactively.

This week’s Members-only Monday research note was From Analyst RFI to Sales Asset: Why Completed Analyst Spreadsheets Belong in Your Deal Desk

(The AR Playbook: AR-Sales Partnership #3)

Independent AR research for a rapidly evolving analyst ecosystem

Lusher Advisory: AR Intelligence

If the research, insights, and webinars help you stay ahead of the curve, please consider supporting this work. Your support funds:

Independent research

Weekly analysis that helps AR teams anticipate analyst-firm shifts, best-practice changes, and AI-driven disruption

Interviews, best practices, and free webinars for the AR community

Free – One hard hitting article per week and alerts

$8 monthly / $80 annually / Team discounts available

Behind-the-paywall research note weekly – Members-only Monday

Monthly analyst firm profile

Monthly members-only on-line meetings

The full archive of AR Intelligence articles

This work is independent by design — and subscriber support is what makes that possible.

Subscribers are AR leaders, practitioners, and analyst-ecosystem insiders who want signal over noise.

© 2025 Lusher Advisory, LLC. All Rights Reserved.

This report is copyrighted by Lusher Advisory. Unauthorized distribution or reproduction is prohibited. If you would like to license this report for broader use, including sharing with clients, prospects, or internal teams, reprints are available. Contact Lusher Advisory for details on licensing options.

Sharp analysys of how AI polarizes rather than democratizes influence. The Long Tail to barbell metaphor captures something real that I've seen playout across other sectors too, not just analyst firms. What's interesting is that the skinny middle often has strong domain expertise but lacks either the data moats or the operational agility to leverage AI effctively. I dunno if Wave 3 is the final form or just another transiton, but the structural shift you describe feels permanent.