Gartner's Federal Contracts Under DOGE's Axe: AR Impact Alert

Breaking Analysis: DOGE has already cut 11 Gartner Federal contracts, with $58M more at high risk in Q2-Q3 2025

AR Intelligence Snapshot

Federal Exposure Quantified: Gartner's $270M in Federal contracts (5% of total CV) faces targeted DOGE cuts with 11 contracts already affected, representing the first wave of a potentially larger impact

Competitive Vulnerability: Forrester faces even greater proportional risk with Federal contracts comprising nearly 10% of its CV while already experiencing eight consecutive quarters of decline

Critical Timeline: Peak exposure periods in April and July 2025 put approximately $58M worth of contracts at renewal risk, with 15-20% potentially facing cuts based on current DOGE patterns

AR Implications: Vendors reliant on Federal influence should develop contingency strategies as Gartner's ability to influence government technology purchases diminishes in targeted agencies

Dig Deeper

From the Gartner 4Q24 Earnings Call, Craig Safian, EVP & CFO, prepared remarks:

With the U.S. Federal Government, we ended 2024 with around $270 million of CV, which is 5% of the total. Our contracts are spread widely across agencies and departments. Around 85% of U.S. Federal CV is in GTS. Almost all the U.S. federal contracts are for one year with renewal spread across the year.

$230m in Global Technology Sales (GTS) contract value (CV) of the overall $270m in CV shows a significant Gartner presence in the US Federal government’s IT strategy and procurement processes. Gartner already has been on the receiving end of 11 contract cuts by DOGE. That said, 11 contracts are a small fraction of the 438 that Gartner had in the Fed’s FY24. The table illustrates the cuts are uneven with some major cuts to large contracts while six contracts had 0% cuts.

Caveat

The information on the DOGE website is notoriously unreliable. The listed contract cuts for Gartner might not be accurate and could be quietly updated or deleted later. In addition, these are likely not the last of the Gartner contracts cut by DOGE, more could show up any day. However, for the purposes of this analysis and AR planning, the information is useful.

During the 4Q2024 Earnings Call, Wall Street analysts asked questions about the state of public sector spending (see below for relevant extracts). However, none of the analysts specifically asked about the exposure to potential DOGE contract cuts. Neither Hall nor Safian volunteered any commentary about the risk of contract cuts.

Another issue to consider is the impact on contract renewals and new contracts in the near future. Unlike the private sector where multi-year contracts are the norm, for the Federal government all contracts are one-year duration with many expiring every week. Issues Gartner faces in renewals and new business include considerable chaos in the Federal workforce, the Administration’s proposed massive Department of Defense budget cuts / reallocations, GOP US Representatives in Congress plan to cut spending to pay for tax cuts, and more. The DOD budget moves could be especially impactful as DOD is Gartner’s largest client with over $81m CV in FY24.

POTENTIAL IMPACT: $9-12M in Gartner Federal CV at high risk in Q2-Q3 2025

Gartner's Federal Contract Exposure: A Month-by-Month Analysis

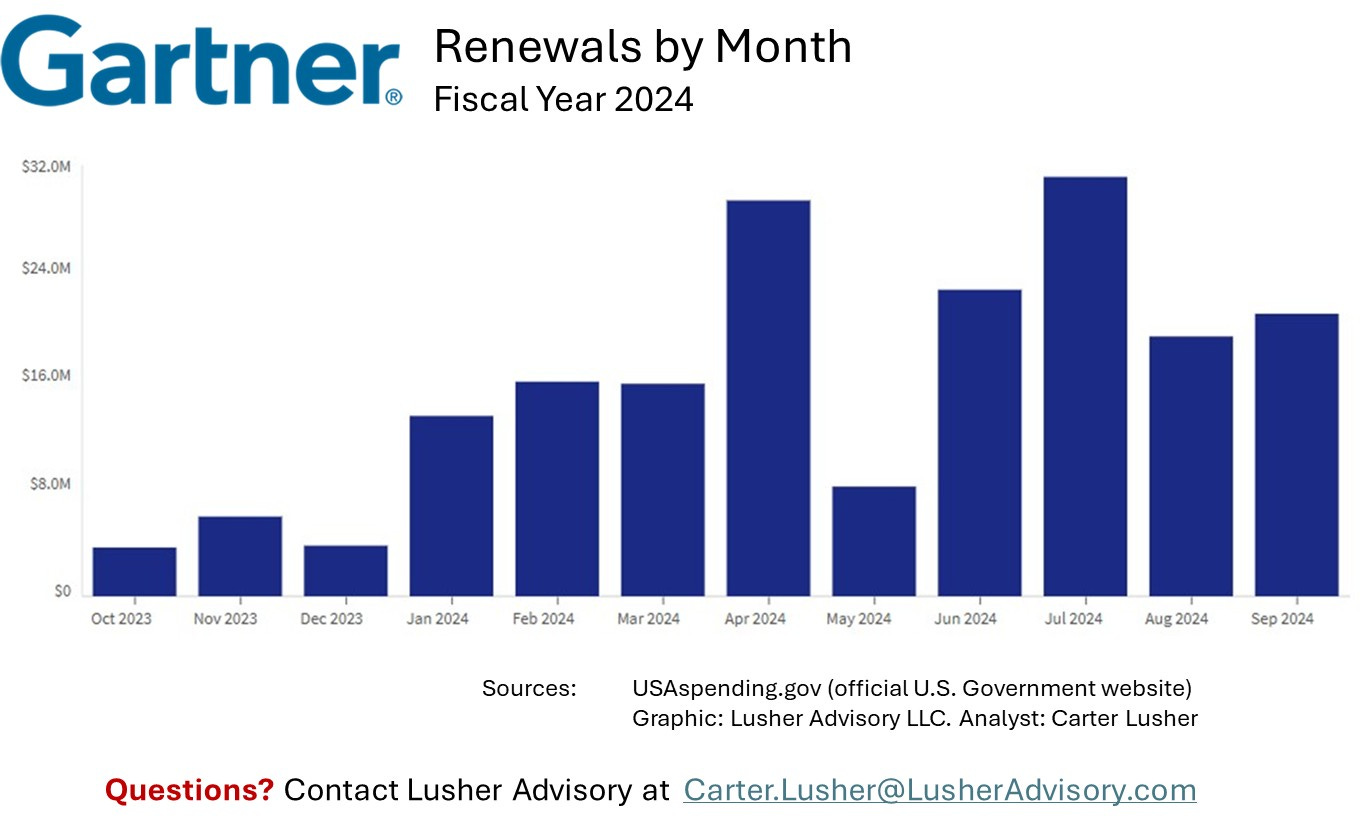

The chart below illustrates Gartner's monthly Federal contract values from October 2023 through September 2024, revealing a critical pattern of exposure to potential DOGE cuts. While the FY25 timeline will be a little different, this is still a valid insight to the monthly pattern of potential impact.

Key Vulnerability Points:

Peak Exposure Periods: July 2024 ($30M) and April 2024 ($28M) represent Gartner's highest concentration of Federal contracts

Upcoming Renewal Cycle: Based on the one-year contract cycle mentioned by Gartner's CFO, these peak months will see significant renewal decisions in Q2 and Q3 2025

Immediate Risk Window: The $20M+ in contracts scheduled for renewal in Jan-Mar 2025 represents approximately 7.5% of Gartner's total Federal CV that will face DOGE scrutiny within the next 90 days

This monthly distribution explains why Gartner executives appear cautious but not yet alarmed—while some contracts have already been cut, the more substantial renewal decisions are still months away. Based on current DOGE patterns, we project that 15-20% of the contracts in the April and July peaks could face significant cuts or non-renewals, potentially representing $9-12M in CV impact.

For vendors heavily dependent on Federal influence, the critical monitoring period will be April-July 2025, when the largest portion of Gartner's Federal advisory contracts will either survive DOGE scrutiny or be eliminated.

Competitive Context: Gartner vs. Forrester Federal Exposure

While Gartner's $270M in Federal contract value captures headlines, our analysis reveals that Forrester faces proportionally higher exposure to DOGE cuts. According to USAspending.gov data, Forrester held just 53 Federal contracts in FY24 valued at approximately $29M—only one-tenth of Gartner's absolute exposure but representing nearly 10% of Forrester's total CV compared to Gartner's 5%. This heightened vulnerability comes at a particularly challenging time for Forrester, which has already experienced eight consecutive quarters of CV decline. IDC's Federal footprint appears significantly smaller or potentially structured differently, as direct contracts were difficult to identify in Federal spending databases. For AR professionals managing relationships across multiple analyst firms, this disparity suggests that DOGE-related disruption could affect analyst influence unevenly across the major firms, with Forrester potentially experiencing more significant disruption to its Federal coverage capabilities despite having fewer absolute dollars at risk than Gartner.

Implications for AR:

As contracts are terminated or not renewed, Gartner's presence in those agencies will diminish, resulting in three specific challenges for AR: (1) fewer Gartner analysts will have firsthand knowledge of agency priorities and buying cycles, (2) Gartner's ability to influence RFPs and requirements documentation will weaken in affected agencies, and (3) competitors with stronger Federal relationships may fill this influence gap by Q3 2025.

As Gartner loses Federal CV there will be pressure to extract more money from existing clients to fill the gap. This is a problem for all Gartner clients, vendors and end users.

While the $9m to $12m potential CV impact represents less than 0.25% of Gartner's total business, the concentrated impact in Federal technology advisory services could significantly alter vendor influence channels.

Action Items for AR:

Conduct Gartner Coverage Gap Assessment: Immediately inventory which of your Gartner analysts cover Federal sectors and monitor changes in their client access. Request specific metrics during your quarterly reviews on the number of Federal briefings and inquiries your analysts are conducting compared to previous quarters.

Develop Federal Influence Diversification Plan: For companies with significant Federal business, create a 90-day plan to diversify your Federal influence channels beyond Gartner. Identify alternative research firms, independent consultants, and industry groups with growing Federal access.

Establish Contract Escalation Protocol: As Gartner faces pressure to recoup Federal losses, prepare your organization for potential mid-cycle upsells or price increases. Document clear internal procedures for when to escalate, which concessions to seek, and your walk-away position.

Leverage Competitive Intelligence: Schedule briefings with your Forrester team to assess their Federal coverage stability, as their higher proportional exposure (10% vs. Gartner's 5%) makes them vulnerable to similar disruptions. Use these insights to inform your overall analyst relations strategy.

Monitor Analyst Reassignments: Watch for signs that Gartner is shifting Federal-focused analysts to commercial sectors, which could indicate longer-term strategy changes. When this occurs, schedule immediate onboarding briefings to ensure these analysts understand your non-Federal value proposition.

Ready to protect your Federal market position?

Schedule a targeted 30-minute strategy session with Lusher Advisory to:Get your personalized DOGE impact assessment -

Understand exactly how these analyst firm contract cuts affect your specific Federal sales channelsDevelop your 90-day Federal influence diversification plan -

Identify the right mix of analyst firms, consultants, and industry groups for your technology sectorCreate your Gartner contract negotiation playbook -

Prepare for potential mid-cycle changes with specific negotiation strategies tailored to your situation